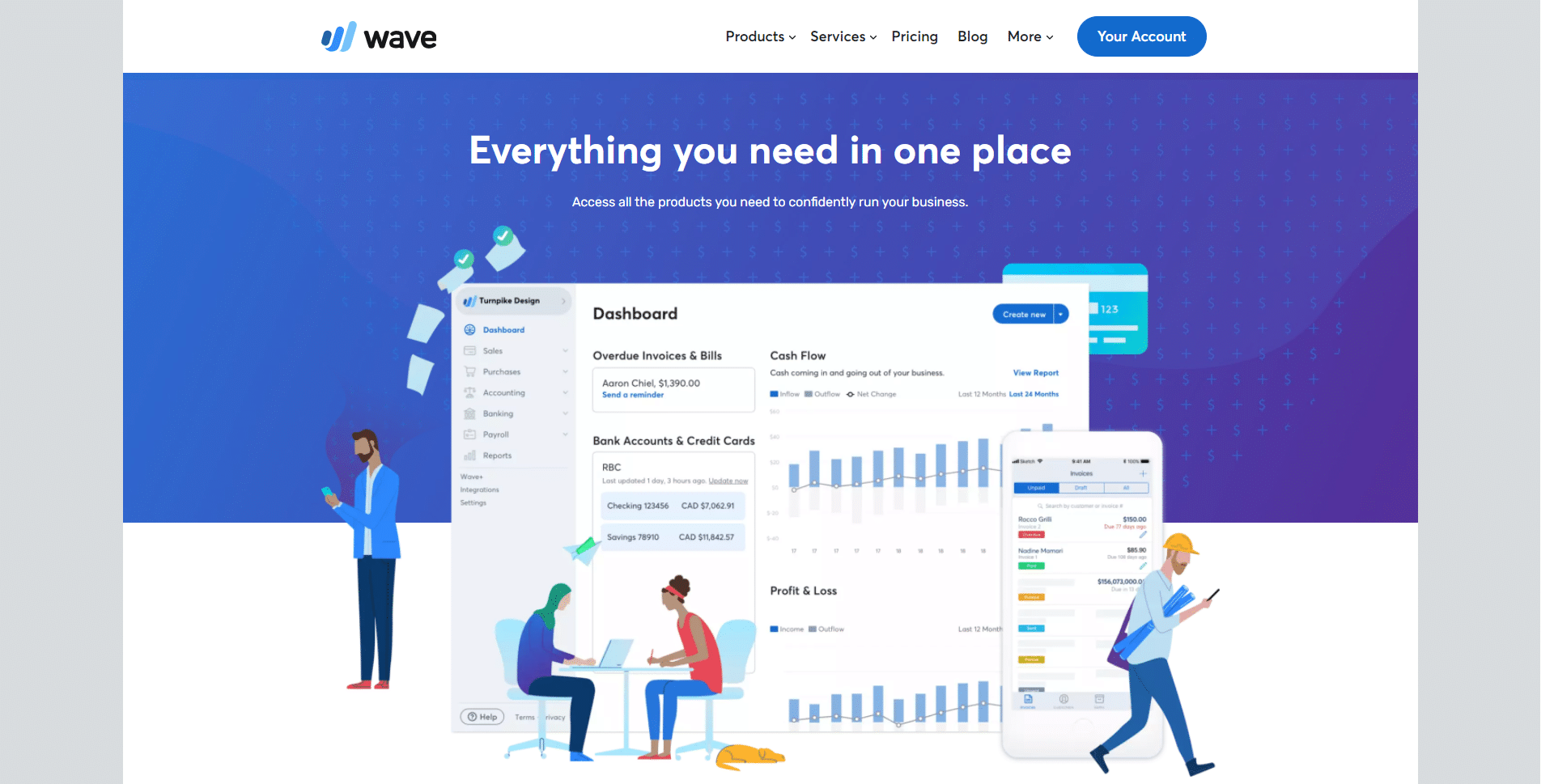

Managing accounts for yourself or your business is no easy task. Many accountants go through years of specialized schooling in order to hone their financial analysis skills. Thankfully, as technology advances have increased, so have programs and applications designed to aid business owners and financial analysts in their work, including the field of accounting. One up-and-coming software program that’s designed to maximize the benefits of both technology and accounting is known as Wave. With Wave Accounting, small business owners can handle their accounting on their own, without racking up extra consulting fees or getting lost in a word of ones and zeros. Wave Accounting is designed to be easy, intuitive, and user-friendly: no jargon, just common sense.

Wave Accounting is a financial software company that was founded in 2010 by Kirk Simpson and James Lochrie. The company’s goal was to provide small businesses with an easy-to-use and affordable alternative to traditional accounting software.

In 2011, Wave Accounting launched its first product, a free invoicing and receipt scanning app for small businesses. The company quickly gained popularity and expanded its offerings to include other financial management tools such as bookkeeping, payroll, and credit card processing.

In 2015, Wave Accounting received a major investment from Goldman Sachs, which allowed the company to expand further and improve its products. In 2018, Wave Accounting was acquired by H&R Block, a leading provider of tax preparation services.

Today, Wave Accounting continues to offer a range of financial management tools to small businesses around the world. The company’s goal is to make it easy for small businesses to manage their finances and grow their businesses.

Wave Accounting is a good alternative to QuickBooks for small businesses that are looking for an affordable and easy-to-use financial management software. It offers many of the same features as QuickBooks, including invoicing, receipt scanning, and bookkeeping, as well as additional features like payroll and credit card processing.

One of the main benefits of Wave Accounting is its pricing. While QuickBooks can be expensive, especially for businesses that need more advanced features, Wave Accounting offers many of its services for free. The company also has paid plans that offer additional features and support, but they are generally more affordable than QuickBooks.

That being said, QuickBooks is a more established and well-known software, and it may be a better choice for businesses that need more advanced features or require more robust customer support. It is ultimately up to the individual business to determine which software is the best fit for their needs.

Wave Accounting offers a range of financial management tools for small businesses, including:

-

Invoicing: Allows businesses to create and send professional invoices to their customers, track payments, and manage their accounts receivable.

-

Receipt scanning: Allows businesses to easily scan and digitize their receipts, making it easier to track expenses and prepare for tax season.

-

Bookkeeping: Provides a range of tools to help businesses manage their finances, including bank reconciliation, profit and loss statements, and balance sheets.

-

Payroll: Offers a payroll service that allows businesses to pay their employees, track vacation time and sick leave, and handle tax compliance.

-

Credit card processing: Allows businesses to accept credit card payments from their customers and track those transactions in their financial records.

-

Expense tracking: Provides tools to help businesses track and categorize their expenses, making it easier to manage their budget and prepare for tax season.

-

Reporting and analysis: Offers a range of reports and analysis tools to help businesses understand their financial performance and make informed decisions.

Overall, Wave Accounting is designed to be an easy-to-use and affordable financial management tool for small businesses. Its goal is to make it easy for businesses to manage their finances and grow their businesses.

Creating a Wave Accounting account is simple, just like the rest of the sight. Your data is always available and backed up externally, creating extra confidence that you can access your information in the event of an emergency. Your software is instantly available to you, so there’s no delay between purchase and installation. All your data is encrypted to the max, using 256-bit encryption to ensure ultimate data integrity and protect both yours and your customer’s information. Wave hosting servers are housed under both physical and electronic protection for additional security, making it a win-win for everyone. As if this weren’t enough, Wave is also PCI Level-1 certified, meaning they’ve been independently reviewed and entrusted with handling credit card and bank account information. With a Wave Account, you can trust you’re putting your information in safe hands.

Wave Accounting is also designed to prioritize your business’s health (and wealth) over time. Wave connects all your bank accounts to one place, automatically recording every transaction. Gone are the days of having to hand-copy every purchase or sale in a giant paper ledger or typing in every digit off your receipt entry; Wave does it all for you in seconds with unlimited connections. Wave is designed to make your information as organized and stress-free as possible, so it also provides synthesis reports that give you an overview of your company at a glance at any moment. You can run monthly or yearly reports and comparisons and keep track of overall spending and cash flow trends. Tax time has never been easier, and if you do hire an accountant to review your data, they’ll appreciate the double-entry, accounting friendly software Wave specializes in.

Wave can also connect to external platforms to track additional revenue streams and business transactions. Shopify, PayPal, Shoeboxed, Etsy: all of these things can tap into your transaction stream with ease, creating the perfect instantly integrated user experience. Accept payments in foreign currency, handle bulk transactions and update them instantly, calculate sales taxes and exchange rates, and more, all with Wave. The best part is that you can do this for as many businesses as you want: Wave recognizes multiple storefronts under the same account.

With Wave Accounting software, running your own business has never been easier. The personalized accounting features are designed to address every component of the small-business journey, and the streamlined and user-friendly interface makes accounting stress-free. If you’re ready to jump into enterprise, Wave Accounting is the perfect software companion to help you.